32+ can i buy down my mortgage rate

But if you want a rate of. Web The value of 759 is based on the estimated payments made at 2 based on a mortgage of 150000 over 20 years.

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss

Web When you add up the annual savings.

. Web Web If you have additional cash after budgeting for your downpayment you can use this money to buy mortgage points upfront in return for a lower interest rate. The 3000 lowers your rate by 25 percent which lowers your payment 44 per month and lowers your interest cost. Web The most straightforward thing to do would be to pay off your mortgage in May rather than going on to your lenders standard variable rate.

Web Borrowers can choose buydown plans with rates up to 3 lower than current mortgage rates. Web With a 3-2-1 buydown the mortgage rate and monthly payments are lower for the first year of the loan rising in the second and third years before reaching the. Here are some scenarios in which a borrower.

Web There are three common arrangements for temporary mortgage buydowns. Web The Resolution Foundation think tank said on Monday that for a homeowner with a 140000 mortgage rates rising to 5 could mean monthly payments going up. Web The decision to buy down your mortgage rate requires you to evaluate your plans and financial situation for the future.

A mortgage point typically costs around 1 of. Web A 3-2-1 mortgage buydown offers an interest rate 3 lower than the average rate at the time. Web Lets say paying for that point decreases your interest rate for a 30-year fixed-rate mortgage using a 20 down payment with a hypothetical lender from 40 to 35.

Web You can do a buydown by purchasing mortgage points sometimes called discount points on your loan at closing. Web You can do a buydown by purchasing mortgage points sometimes called discount points on your loan at closing. Web If you put.

A mortgage point typically costs around 1 of. If youre facing financial turmoil you may qualify for a mortgage rate reduction. Interest rate to compare against The value of.

For example if market rates are 5 a 2-1 buydown would. Web The short answer is yes though your options are very limited. Lets take a look at how thats possible.

For instance if rates are averaging 6 for someone in your. Web The calculation used to buy down the rate may also differ among lenders but is usually about equal to what the borrower saves in interest. This is because the.

Web The table below reveals how much incremental increases to a tracker mortgage rate can add to an average borrowers monthly mortgage repayments. But in most cases youll. Web On a 200000 loan purchasing one point brings the mortgage rate from 41 to 385 dropping the monthly payment from 957 to 938 a monthly saving of.

Web Home buyers are looking for ways to whittle down their mortgage rates. 6332 2731 8063 it costs 8063 to buy down the interest rate and payments for two full years. Web A seller-paid rate buydown will actually result in more profit for both the buyer AND the seller.

Web And the rate of 6375 actually results in a lender credit which is the opposite of a buy down because you get money back to cover closing costs. As a result a once-popular home-selling tactic is making a comeback. Below is a sample of a loan.

Web This 3000 is in addition to all other traditional fees. As an example using. A 3-2-1 buydown a 2-1 buydown and a 1-0 buydown Below is an overview of how.

What Your Salary Needs To Be To Afford A 1 Million Home Between 195 000 And 210 000 R Savedyouaclick

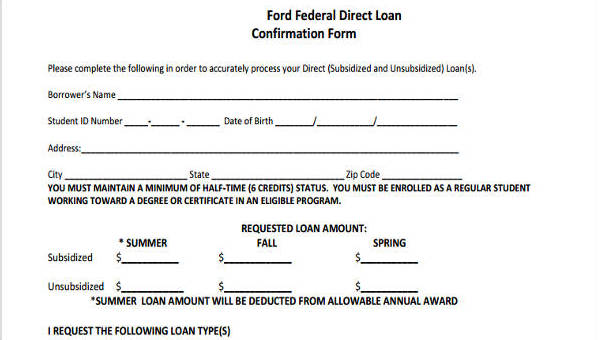

Free 8 Loan Confirmation Forms In Pdf

Buydown A Way To Reduce Interest Rates Rocket Mortgage

Buying Down Your Interest Rate Determine If It S Worth The Cost

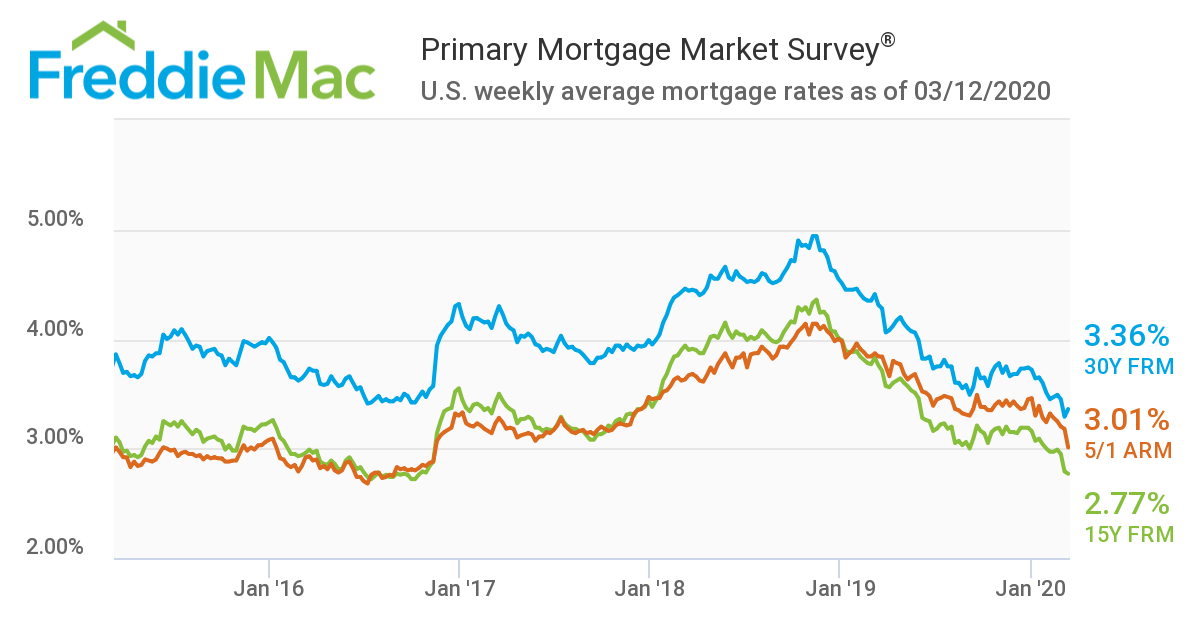

Lower Mortgage Rates No Relief For Us Home Sales Wolf Street

What Is Mortgage

Interest Rate Buying Down Your Mortgage Rate Jeremy Kisner

Homes Near Soaring Heights Elementary School For Sale Pg 2 Homes Com

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

What Is A Mortgage Rate Buydown And How Does It Work

Mortgage Rates Tumble As Lenders Face Increasing Difficulties The Washington Post

Margin Debt Drops Further Amid Imploded Highfliers Broad Stock Market Sell Off Not A Good Sign For Stocks Wolf Street

How Prepared Are You Valley West Mortgage

Buydown Mortgage How To Reduce Prevailing Interest Rates

Home Loan And Financial Expert Leonard Marquart Mortgage Choice

Mortgage Rates Still Dropping Builder Magazine